Bank statement loans allow freelancers, gig workers, contract workers, entrepreneurs, and self-employed individuals the opportunity to qualify for a mortgage without using W-2s or tax return information. Instead, lenders rely on bank statements – but how does that affect bank statement loan interest rates?

In this article, we’ll offer a complete guide to bank statement loan interest rates. We’ll start generally, with an explanation of how interest rates work and why banks charge higher rates for certain loans before diving into bank statement loans in particular.

If you’re already familiar with how interest rates work and you’re just looking for specific information on what we here at Defy Mortgage currently offer in terms of bank statement loan requirements, you can scroll down to the section titled, “Bank Statement Loan Terms from Defy Mortgage.”

The world of real estate financing can be very, very confusing, which is why doing your research right from the start is crucial. It helps to focus your research as generally as possible to start to make sure that you have a firm understanding of the basic stuff before we dive into the more complicated topics.

With that said, what’s an interest rate? At its most simple, interest is the cost of borrowing money. An interest rate is the cost of borrowing money over time .

The bank or lender you work with doesn’t just give money away for free. Instead, they earmark a certain amount of money for a certain purpose and assign an interest rate to it based on how risky it is to give that person money. This can vary my bank and lender. Here’s an example:

So, now that you have a basic understanding of how interest rates work, why do banks charge higher interest rates on certain loans? Why do some people have mortgages with debt as low as 3% while other people have credit card debt as high as 25%?

Well, we alluded to it above, but the reason is that the bank sees lower interest debt as being less risky than higher interest debt. When the bank lends money to someone to help them buy a house, they know that they can just take the house back if the person stops paying the loan. If someone uses a credit card, on the other hand, they might have used that money to buy an expensive fireworks show for their son’s birthday – hardly something that the bank can take back to recoup their losses.

Well, it seems simple at first. It gets much more complicated when you start to consider other factors – like how the Federal government sets interest rates by printing less (or more) money, global economic activity, unemployment rates, and everything else.

A bank statement loan is a type of non-QM mortgage that allows borrowers to use their bank statements to buy a home.

Traditional mortgages require borrowers to provide W-2s as proof of income. Bank statement loans are a bit different. Even though the number of freelancers is on the rise , bank statement loans are considered non-traditional. Typically, borrowers are expected to provide 12-24 months of bank statements in order to demonstrate cash flow and income from either personal or business bank statement documentation.

Below, we outline exactly what Defy is looking for when someone applies for a bank statement loan – but first, we’ll give you an example of what a bank statement loan might look like.

Matt is self-employed. Over the past three years, his freelance writing business has earned a little over $7,400 a month. He has student loans of about $650 a month. He’s been having trouble qualifying for a traditional mortgage due to his income. Since it fluctuates and lenders like to see W-2s, he’s been denied for conventional mortgages in the past.

At an 8.5% interest rate with a bank statement loan, Matt could theoretically qualify for a mortgage in the $200-$250k range, depending on some other factors like his credit score and money down.

Bank statement loan interest rates highly correlate with traditional mortgage rates. Depending on your eligibility criteria, the rates can be very competitive. As of January 2024, the current 30-year fixed mortgage rate stands at about 7.03%.

Since a bank statement loan is a non-traditional loan, though, these tend to be a bit higher than traditional mortgage rates by about 1-2%.

Bank Statement Loan Terms from Defy Mortgage

Defy Bank statement loan terms 1 | Defy Mortgage" width="440" height="251" />

Defy Bank statement loan terms 1 | Defy Mortgage" width="440" height="251" />

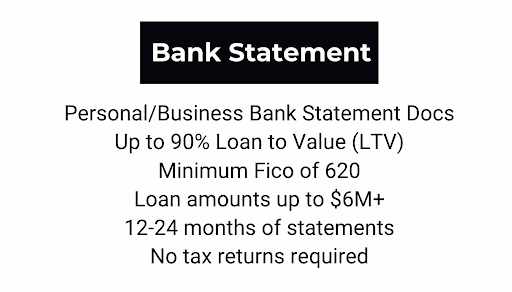

When you apply for a bank statement loan from Defy Mortgage , we won’t ask for tax returns or your W-2. Instead, we’ll need to see 12-24 months of your bank statement (personal or business) documents. Other requirements include:

Qualifying for the best possible interest rate can seriously decrease the amount of money that you’ll pay over the lifetime of a loan. Shopping around for the best possible lenders for bank statement loans could save you tens of thousands of dollars. One thing you’ll want to consider: going to a lender who specialized in non-QM loans (the type of loans that bank statements are).

How Different Interest Rates Affect the Monthly Payment and Total Payment of a $320K Mortgage

| Interest Rate of 7.5% | Interest Rate of 7% | Interest Rate of 6% | |

| Monthly Payment | $2,237.49 | $2,128.97 | $1,918.56 |

| Total Payment | $485,495.11 | $446,428.47 | $370,682.20 |

As you can see above, an interest rate of 7.5% on a $320k mortgage means that you’ll pay $485k over the course of a 30 year mortgage.

A 1.5% drop in the interest rate means that you’ll pay only $370k. That’s a decrease of over 24%!

Additionally, if you’re looking to decrease monthly costs – which can be the difference between cash flowing and breaking even on a rental property – that same 1.5% difference in the interest rate equates to over $200 less per month.

You can potentially reduce the interest rate for a bank statement loan by shopping around for mortgage rates, putting more money down, having a better credit score, or having a very low DTI ratio.

Different mortgage lenders offer different rates. Sometimes mortgage lenders offer low promotional rates to incentivize buyers to go with them. At Defy, we offer competitive rates on our bank statement loans, giving our client’s tailored options to meet their unique needs — no application fee or obligation when you apply — and access to 24/7 one-on-one white glove service from your own personal Mortgage Consultant.

As we mentioned above, your credit score is a gauge for how “risky” it is to lend money to you. If you have a low credit score, banks and lenders are worried about getting their money back. When banks and lenders are worried about getting their money back, they charge higher interest. If you want to decrease the amount of interest that you’ll have to pay, one of the best ways is to increase your credit score.

Most mortgage lenders won’t lend on a bank statement loan without putting at least 20% down. With the median home value in the USA sitting at about $410k as of January 2024, that means that some lenders will require you tol have to saved up about $80k in order to buy a home with a bank statement loan. At Defy, however, we offer up to 90% LTV which equites to 10% down.

When an asset is income-generating, most lenders see it as safer than other loans. Sometimes you can get a lower interest rate by showing that the asset, in some ways, pays for itself. Since you’re borrowing money to purchase something that’s already generating money, it’s a little bit less risky than borrowing money to buy a vacation home. This can result in a lower interest rate.

While it might not improve the monthly payment, one way that you can reduce your interest rate is by reducing the amount of time that it’ll take you to pay it back. Some lenders see longer loans as more risky, while shorter loans tend to have lower interest rates.

Finally, another way that you can find the lowest interest rate available for your situation is to look into other loan types. Those might include other non-QM loan options . The right lender will work together with you to find something that fits your situation.

How does a bank statement mortgage work?

A bank statement mortgage works by using bank statements as proof of income for loan qualification instead of traditional income documentation.

Are bank statement mortgages good?

Bank statement mortgages are very good if you’re a freelancer, self-employed, gig worker, or business owner. If you’d be unable to qualify for a mortgage any other way, bank statement mortgages can allow you to qualify.

Who is a good candidate for a bank statement loan?

Freelance employees, contract workers, consultants, realtors, retirees, sole proprietors, gig economy workers, business owners, independent contractors, entrepreneurs are all examples of people who might be good candidates for bank statement loans. If you don’t have a W-2 but you have income, you could be a good candidate.

How much down payment is required for a bank statement mortgage?

At Defy, at least a 10% down payment is required for a bank statement mortgage. Many other lenders require anywhere from 15-20%.

What’s the difference between a bank statement loan and a traditional loan?

A traditional mortgage uses W-2s as a source of income, to show that you can repay the loan. Bank statement loans use bank statements – either personal or business – since not everyone has a W-2 or a traditional job.

Can I use a bank statement loan on a second home?

You can use a bank statement loan on a primary residence, second home, vacation home, or an investment property.

Do bank statement loans work for refinancing?

You can definitely refinance your current loan into a bank statement loan. If you can get a lower interest rate using a bank statement loan, it can be a great option for refinancing.

Do bank statement loans work for FHA loans?

The FHA has strict criteria when it comes to what types of mortgages they’ll insure. Therefore, since bank statement loans are a non-traditional loan option, bank statement loans don’t work for FHA loans.

Do bank statement loans require PMI?

Bank statement loans may or may not require PMI, depending on the lender. At Defy, we don’t require PMI for bank statement loans once your LTV drops below 80%.

How much income do you need for a bank statement loan?

As of January 2024, interest rates for bank statement loans are in the 8-10% range. If you’d like to qualify for a $300k mortgage at an 8.5% interest rate, you’ll need to make about $95k per year.

How many months of bank statements to qualify for a bank statement loan?

The exact number of months of bank statements required varies between lenders. However, the general rule of thumb is to prepare between 12 to 24 months of bank statements.

How do I apply for a bank statement loan?

If you’re ready to apply, click HERE to get started.